As we step into 2024, the world of digital finance continues to evolve, with cryptocurrencies at the forefront. These digital assets have captured the public’s imagination, leading to widespread adoption and discussion. This guide aims to shed light on the intricacies of cryptocurrency transactions, which remain a mystery to many.

Understanding how these transactions are processed is crucial for anyone looking to participate in this rapidly growing digital economy. Whether you’re a seasoned investor or a curious newcomer, this guide will navigate the complex yet fascinating world of cryptocurrency transactions.

What is a Cryptocurrency Transaction?

A cryptocurrency transaction is more than just a digital transfer of funds. It’s a complex process that involves various elements working in tandem.

At its core, a cryptocurrency transaction is a transfer of digital assets between two parties’ digital wallets. This process relies heavily on blockchain technology, a decentralized and distributed ledger that records all transactions across a network of computers.

The blockchain ensures that each transaction is secure, transparent, and irreversible. These transactions are not just mere exchanges of value; they are the bedrock of a new financial paradigm, offering a level of security and efficiency previously unattainable in traditional finance.

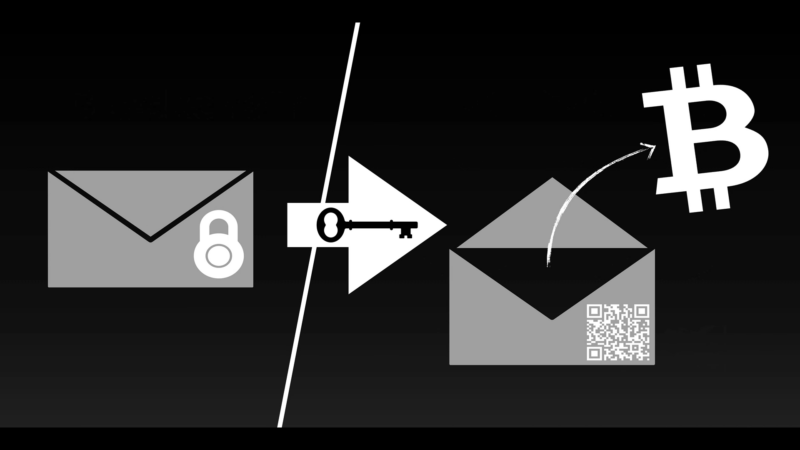

Public and Private Keys

In the realm of cryptocurrencies, public and private keys play a pivotal role in securing transactions. The public key can be compared to a mailbox’s address, where anyone can send digital currency. The private key, on the other hand, is akin to the key to that mailbox, allowing only the owner to access and send their funds.

It is essential for users to understand the importance of these keys: while the public key is meant to be shared, the private key must be guarded with utmost secrecy. Losing the private key can result in losing access to one’s digital assets. To learn more about this subject please visit this site.

Wallets and Addresses

Cryptocurrency wallets are central to managing and conducting transactions in the digital currency space. These digital wallets don’t store physical coins; rather, they keep records of transactions. Each wallet is associated with a unique address – a string of letters and numbers – which functions like an account number.

When a user wishes to receive cryptocurrency, they provide this address to the sender. Wallets come in various forms: software-based (online, desktop, or mobile) and hardware-based (physical devices). Each type offers different levels of security and accessibility.

Initiating a Transaction

Initiating a cryptocurrency transaction involves a simple yet secure process. The sender must have the recipient’s wallet address and the amount of cryptocurrency to be transferred.

To initiate the transaction, the sender enters this information into their wallet application. At this stage, a transaction fee is also specified, which is paid to the network miners for processing the transaction. This fee varies depending on the network’s congestion and the transaction’s urgency.

Users must carefully review all transaction details, as blockchain transactions are irreversible. Once confirmed, the transaction is broadcasted to the network, awaiting validation by the miners.

Transaction Verification

The verification of cryptocurrency transactions is a critical component of blockchain technology. When a transaction is initiated, it is broadcasted to the network where miners, using powerful computers, begin to verify it. These miners solve complex cryptographic puzzles to validate the transaction and add it to a new block on the blockchain.

This process ensures the integrity and security of the transaction, preventing issues such as double-spending. Various cryptocurrencies use different consensus mechanisms, such as Proof of Work or Proof of Stake, to achieve agreement among network participants.

Confirmations and Security

After a transaction is added to the blockchain, it begins to receive confirmations. Each new block added to the chain after the transaction block counts as one confirmation. The more confirmations a transaction has, the more secure it is considered.

This is because it becomes increasingly difficult to alter the transaction with each subsequent block added. Many wallets and services require a certain number of confirmations before considering a transaction final. Unconfirmed transactions carry a risk: they can be reversed or double-spent.

Transaction Speed and Scalability

The speed of cryptocurrency transactions varies widely among different blockchain networks. Bitcoin transactions, for example, can take from a few minutes to several hours, while other cryptocurrencies may offer faster processing times. This variation is largely due to the scalability challenges faced by blockchain networks.

As the number of users and transactions grows, the network can become congested, leading to slower transaction times and higher fees. To address these challenges, various solutions are being explored, including off-chain transactions, sharding, and newer consensus mechanisms. Improving transaction speed and scalability is crucial for the widespread adoption and long-term viability of cryptocurrencies.

Smart Contracts

Smart contracts represent a significant advancement in the use of cryptocurrency technology. These are self-executing contracts with the terms of the agreement directly written into code. They automate transactions when predetermined conditions are met, without the need for intermediaries.

Smart contracts have a wide array of applications, from automating payments to executing complex contractual clauses. They are most commonly associated with Ethereum, but many other blockchain platforms now support them.

Smart contracts enhance the efficiency, transparency, and trust in digital transactions, opening new possibilities for decentralized applications and financial instruments.

Privacy and Anonymity

Privacy and anonymity in cryptocurrency transactions vary depending on the blockchain. Some, like Bitcoin, are pseudonymous, recording transactions on a public ledger without revealing the users’ real identities.

Others, like Monero and Zcash, offer enhanced privacy features, obscuring transaction details to provide greater anonymity. This level of privacy is crucial for users who value confidentiality in their financial transactions. However, it also raises concerns about the potential misuse of cryptocurrencies for illicit activities.

Common Transaction Issues

Users may encounter various issues when conducting cryptocurrency transactions. Common problems include entering incorrect addresses, setting low transaction fees resulting in delayed confirmations, and falling victim to phishing attacks.

To avoid these issues, it’s crucial to double-check all transaction details, use recommended transaction fees, and ensure wallet security. If problems arise, most blockchain networks offer tools to track and troubleshoot transactions.

Conclusion and Future Trends

Cryptocurrency transactions have come a long way since their inception, evolving into a sophisticated and secure means of digital exchange. The future promises further innovations, with developments in scalability, speed, and security.

Emerging trends like Layer 2 solutions, cross-chain interoperability, and central bank digital currencies (CBDCs) are set to redefine the landscape. Staying informed and practicing secure transaction methods are essential for anyone participating in this dynamic field.

Related Posts:

- How to Transfer Crypto to Bank Account: 10 Tips for…

- Social Media Revenue: Effective Management for…

- How to Manage All of Your Online Casino Accounts…

- Top 7 Luck-Based Casino Games: Tips for Choosing and…

- How to Successfully Make Money on OnlyFans as a…

- How to Win a Debt Collection Lawsuit with Confidence…